(WASHINGTON D.C.) — On Monday, USDA called for higher corn and soybean ending stocks along with a slightly higher 2025 U.S. corn yield.

According to the January 2026 World Agricultural Supply and Demand Estimates (WASDE) report, corn production is estimated at 17.0 billion bushels, up 269 million on a 0.5-bushel increase in yield to 186.5 bushels per acre and a 1.3-million acre rise in harvested area. Since the July 2025 WASDE, harvested area has surged 4.5 million acres. Notably, the record crop in 2025 exceeds the prior high set in 2023 by 1.7 billion bushels or over 40 million tons.

With supply rising more than use, U.S. corn ending stocks are boosted 198 million bushels to 2.227 billion bushels, up from the average trade guess at 1.972 billion. The season-average corn price received by producers is raised 10 cents to $4.10 per bushel. Total corn use is raised 90 million bushels to 16.4 billion. Feed and residual use is up 100 million bushels to 6.2 billion, based on indicated disappearance during the September-November quarter as reflected by the Grain Stocks report. Food, seed, and industrial use is down slightly reflecting reductions in the amount of corn used for glucose and dextrose and high fructose corn syrup.

U.S. oilseed production for 2025/26 is estimated at 126.2 million tons, up 0.5 million from the previous report. Higher soybean, canola, and sunflower seed crops are partly offset by lower cottonseed and peanuts. U.S. soybean production is estimated at 4.3 billion bushels, up 9 million, led by increases for Kansas, Kentucky, and Minnesota. Harvested area is estimated at 80.4 million acres, up 0.1 million. Yield is unchanged from last month at 53.0 bushels per acre. U.S. soybean supply for 2025/26 is raised 17 million bushels on higher beginning stocks and production.

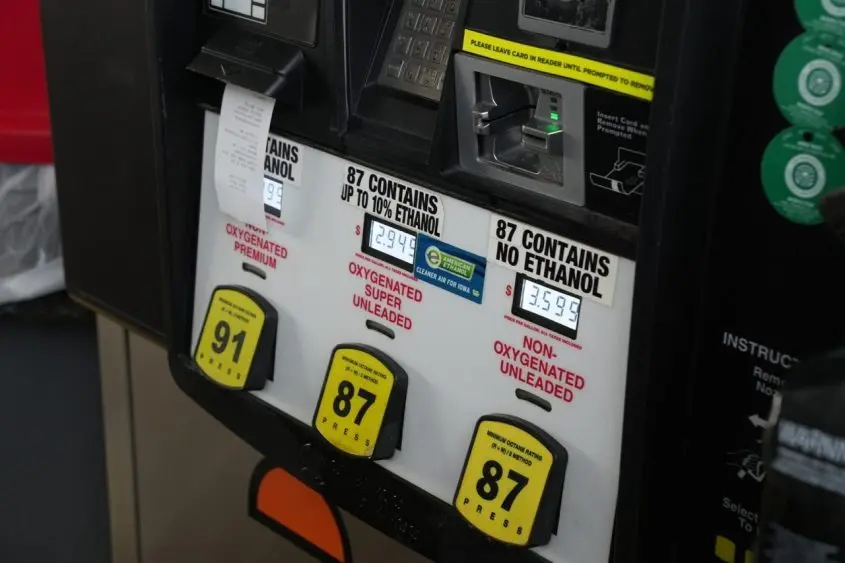

Soybean crush for 2025/26 is raised 15 million bushels to 2.57 billion bushels on higher soybean meal domestic disappearance and exports. Soybean meal and soybean oil extraction rates are also revised based on early-season data. Soybean oil used for biofuel is lowered 0.7 billion pounds to 14.8 billion on lower-than-expected use to date and strong use of tallow as a feedstock in recent months.

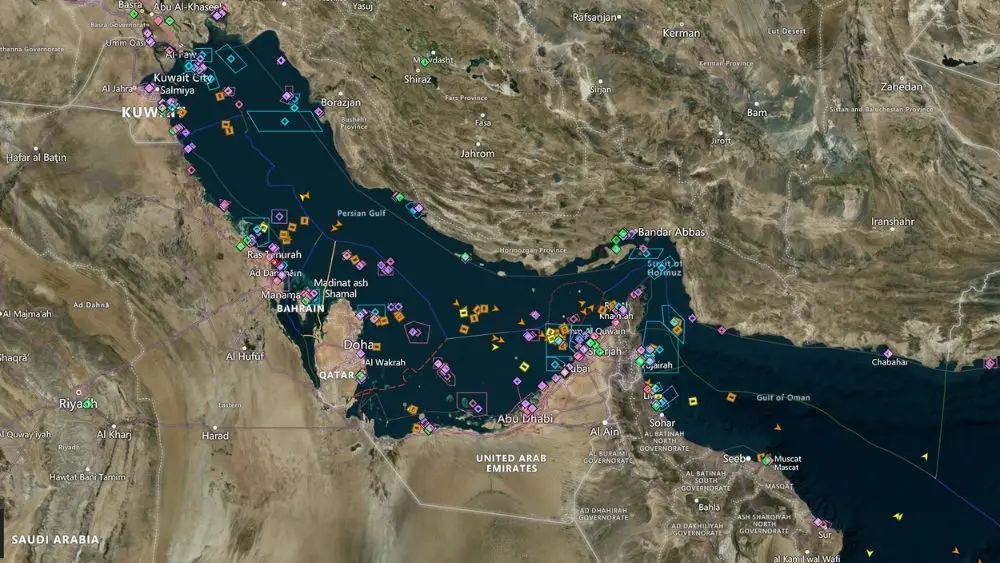

U.S. soybean exports are revised 60 million bushels lower to 1.575 billion on higher production and exports for Brazil. Soybean ending stocks are projected at 350 million bushels, up 60 million. The U.S. season-average soybean price for 2025/26 is projected at $10.20 per bushel, down 30 cents, reflecting reported NASS prices during the first quarter of the marketing year and expectations for future marketings and prices. The soybean meal price is forecast at $295 per short ton, down $5. The soybean oil price is unchanged at 53 cents per pound.

The outlook for 2025/26 U.S. wheat this month is for slightly larger supplies, lower domestic use, unchanged exports, and larger ending stocks. Beginning stocks are raised 4 million bushels on stock revisions in today’s NASS Grain Stocks report. Feed and residual use is reduced 20 million bushels to 100 million based on smaller-than-expected first quarter disappearance and residual indicated in the same report. Seed use is lowered 1 million bushels to 61 million, partly based on the NASS Winter Wheat and Canola Seedings report. Exports are unchanged at 900 million bushels, but there are offsetting by-class changes. Projected ending stocks are raised 25 million bushels to 926 million, up 8 percent from the previous year. The season-average farm price is lowered $0.10 per bushel to $4.90.

View the January WASDE Report here: https://www.usda.gov/oce/commodity/wasde/wasde0126.pdf

View the January Grain Stocks Report here: https://esmis.nal.usda.gov/sites/default/release-files/795726/grst0126.pdf

View the January Winter Wheat and Canola Seedings Report here: https://esmis.nal.usda.gov/sites/default/release-files/795728/wtrc0126.pdf

Hear comments with Arlan Suderman, Chief Commodities Economist at StoneX below:

***Always remember that risk of trading futures and options can be substantial.