Farmer sentiment softened modestly in December as the Purdue University–CME Group Ag Economy Barometer Index slipped 3 points to a reading of 136. The slight weakening in the barometer was tied primarily to a pullback in producers’ long-term outlook. The Future Expectations Index declined 4 points from November to 140, while the Current Conditions Index held steady at 128. Survey results point to growing unease surrounding U.S. soybean export prospects, particularly as competition from Brazil continues to intensify, contributing to a somewhat less optimistic outlook among crop producers. The December barometer survey was conducted from December 1–5, 2025.

Expectations for individual farm financial performance showed little movement compared to November. The Farm Financial Performance Index edged 2 points higher to 94, reflecting a shift toward more producers indicating they expect this year’s financial performance to be about the same as last year’s. The Farm Capital Investment Index also rose slightly, gaining 2 points to reach 58. Even with that increase, a clear majority of producers, 60%, continued to say December was a bad time to make large investments in their operations.

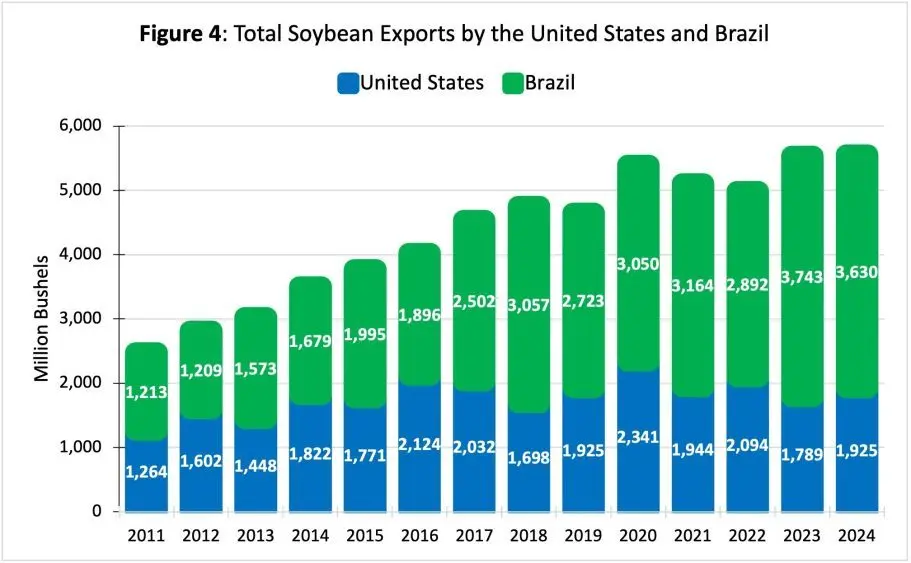

Views on the future of U.S. agricultural exports were mixed. When asked broadly about export prospects, producers expressed one of their most optimistic outlooks of the year, with only 5% anticipating a decline in agricultural exports over the next five years. However, sentiment turned more cautious when growers focused specifically on soybeans. In December, 13% of corn and soybean producers said they expect soybean exports to decline during the next five years, up from 8% in November. At the same time, the share of growers expecting soybean exports to increase over that period fell from 47% in November to 39% in December. Concerns about competition from Brazil remain widespread, with 84% of corn and soybean producers saying they were concerned or very concerned about the competitiveness of U.S. soybean exports relative to Brazil, including 45% who said they were very concerned.

Optimism surrounding farmland values remained intact. Both the Short-Term Farmland Value Expectations Index and the long-term index posted 1-point gains compared to November. The short-term index rose to 117, placing it 11 points above its most recent low in September and 7 points higher than its level a year earlier. The long-term farmland value expectations index reached 166, setting a new record high. That reading stands 20 points above its September low and 11 points above a year-ago levels.

Confidence in tariffs as a tool to strengthen the U.S. agricultural economy showed signs of erosion. In December, 54% of respondents said they expect tariffs to strengthen the agricultural economy, down from 58% in October and 59% in November. The share of farmers who said they are uncertain about the long-term impact of tariffs increased to 19%, up from 17% a month earlier. Since the spring, when the question was first introduced, the percentage of producers expressing uncertainty about tariffs’ long-run effects has more than doubled. Even so, sentiment about the broader direction of the country remained positive. Three-fourths of respondents, 75%, said the U.S. is headed in the “right direction” rather than on the “wrong track,” the highest reading since that question was added to the survey in July.

Overall, farmer sentiment drifted lower in December as producers became slightly less optimistic about the future compared to November. The modest decline came despite improved views on farm financial performance and slightly stronger expectations for farmland values. Ongoing uncertainty surrounding agricultural trade continues to weigh on sentiment. Nearly one in five producers said they are unsure how U.S. tariff policy will affect agriculture over the long run. At the same time, almost 9 out of 10 corn and soybean growers reported concerns about rising competition from Brazil affecting U.S. soybean exports, a factor that likely continues to pressure expectations for the future.

See the full report here.