WASHINGTON, D.C.—Growth Energy, the nation’s leading biofuel trade association, welcomed reports that the proposal released today by the House Ways and Means Committee included an extension of the 45Z clean fuel production tax credit, an incentive that would spur innovation in American biofuels and unlock billions in new investments across rural America.

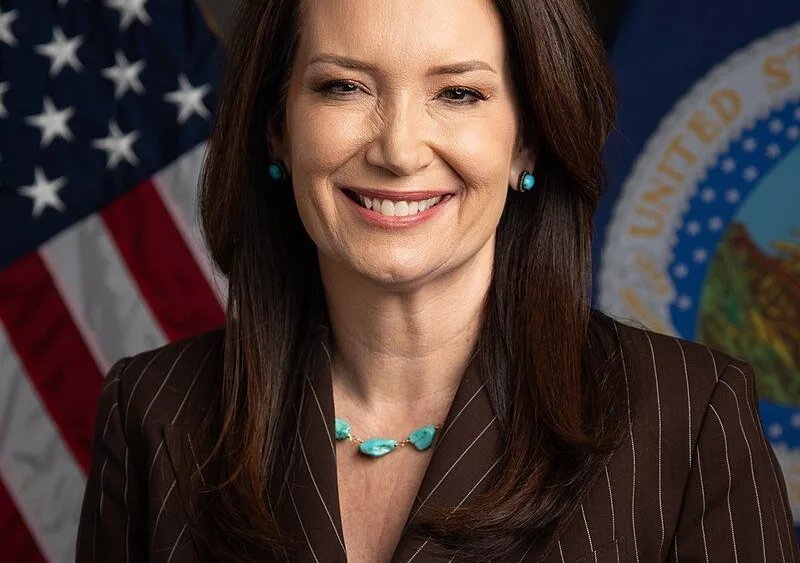

“Pro-growth tax policy can unlock billions of dollars in new investments towards U.S. energy dominance while supporting stronger markets for America’s farmers. The 45Z tax credit is a critical piece of this puzzle, and we’re glad to see that lawmakers on the House Ways and Means Committee recognize its importance,” said Growth Energy CEO Emily Skor. “By including it in the reconciliation bill, this proposal would give biofuels producers a longer runway to innovate and to make investments in creating new markets for farmers. We’re grateful to the Committee, and to our champions on Capitol Hill who have worked hard to ensure that rural priorities like 45Z are included in any final tax bill. As Congress completes its work on the President’s agenda, we urge our champions to remain focused on ensuring that U.S. farmers and biofuel producers have the certainty they need to invest in long-term growth.”

The 45Z clean fuel production tax credit is intended to incentivize the production of low-carbon fuels in transportation on the ground and in the air. If implemented properly, Growth Energy’s own research demonstrates that the credit would add $21.2 billion to the U.S. economy, generate nearly $13.4 billion in household income, support more than 192,000 jobs across all sectors of the national economy, and provide farmers with a 10 percent premium price on low carbon corn used at a bioethanol plant.

SOURCE: Growth Energy Press Release